Over the previous few days, Avalanche has skilled important losses, plunging by way of nearly 20%. On a weekly time frame, AVAX has misplaced 10% of its marketplace worth. Despite the fact that the day by day time frame signifies that AVAX has made a slight upward motion on its chart, with an appreciation of one.6%, the technical outlook for Avalanche stays bearish.

Patrons had been wary about worth actions whilst dealers have ruled the marketplace, resulting in a lower in each call for and accumulation at the day by day chart. To ensure that the Avalanche worth to enjoy some reduction, it wishes to wreck above the $18 mark.

Then again, the $17 worth stage has acted as a provide zone for the altcoin. If bulls can not shield the present worth mark of the altcoin, the bears might take complete keep an eye on of the asset’s worth.

Very similar to different outstanding altcoins, main marketplace movers had been suffering to wreck their a very powerful resistance ranges. The decline in AVAX’s marketplace capitalization signifies a lower in purchasing force out there.

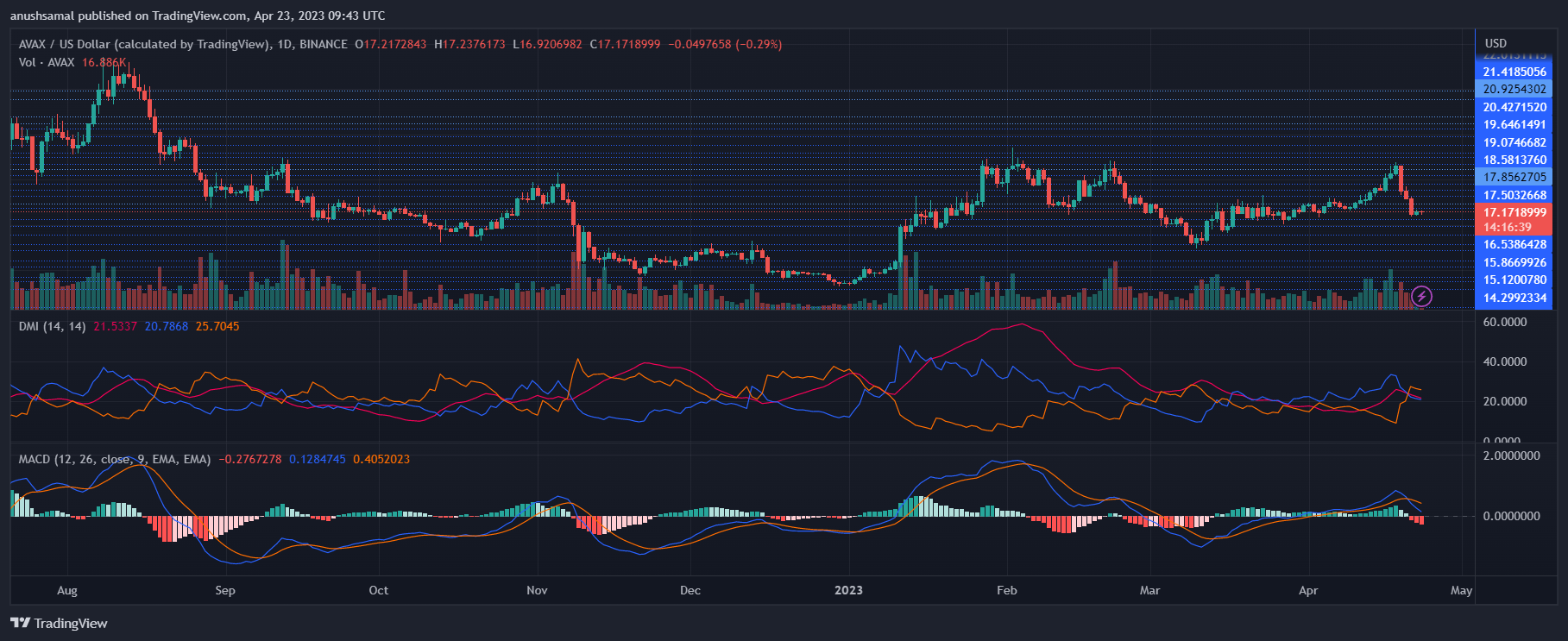

Avalanche Worth Research: One-Day Chart

On the time of writing, AVAX used to be priced at $17.17. The rapid resistance for the altcoin used to be at $18, and if breached, may just result in a push in opposition to $19, thereby strengthening the bulls.

Then again, if Avalanche endured to business sideways, a fall beneath the $17 stage used to be anticipated. In this type of case, the following fortify stage for the asset used to be $15.

The altcoin’s restoration used to be depending on patrons stepping in to push its worth above the $18 mark. The new quantity of AVAX traded used to be crimson, which prompt an build up in promoting force out there.

Technical Research

Over the last week, there was a vital drop in call for for the altcoin, resulting in a decline in its worth. In spite of efforts by way of bullish traders to regain purchasing power, it is very important to surpass rapid resistance to make development.

The Relative Power Index signifies that dealers outnumber patrons, with the index beneath the 50-mark. Although there was a minor upswing, the bearish affect continues to dominate.

Moreover, the AVAX worth stays beneath the 20-Easy Transferring Reasonable, indicating that dealers are gaining momentum and steerage the marketplace’s worth motion.

As well as, additional technical signs counsel that bearish momentum is prevailing. The Transferring Reasonable Convergence Divergence indicator presentations the fee momentum and reversals out there. At the one-day chart, crimson histograms have shaped, indicating promote indicators.

The Directional Motion Index determines the fee course, and lately, the -DI line (orange) is above the +DI line (blue), leading to a destructive DMI studying. The Reasonable Directional Index (crimson) is above the 20-mark, indicating that the fee momentum is gaining power.

Featured Symbol From UnSplash, Charts From TradingView.com